Taxes and Insurance

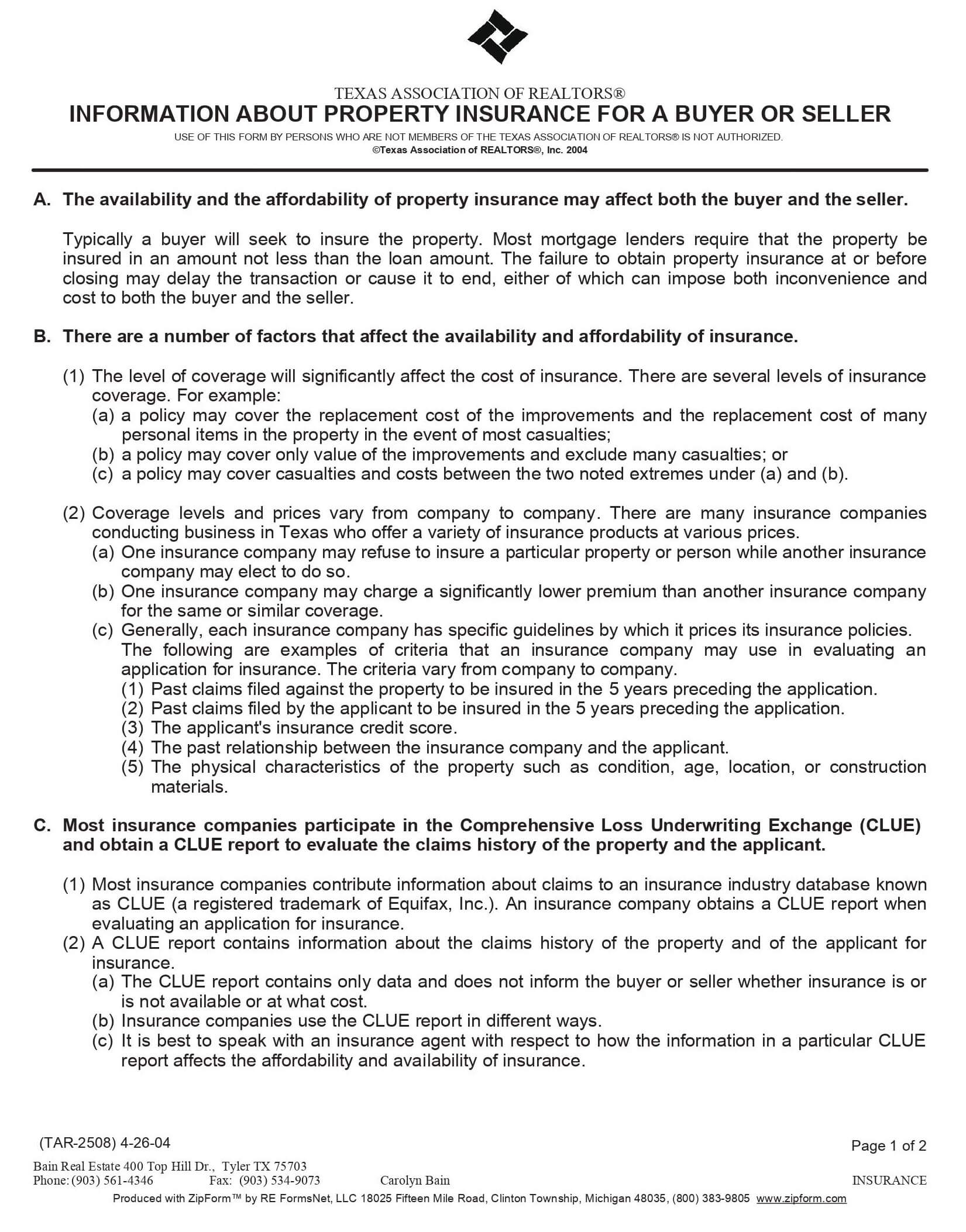

North Texas Property Tax Rates

Property taxes are part of the homeownership experience. But it’s easy for buyers to overlook the impact property taxes will have on their bottom line. Here is an example of how the tax rate can affect your monthly payment.

The assessed value is not the same as the price you paid for the house or how much you can sell it for, which is called the “appraised” or “market” value. Your local government’s tax or property assessor sets the assessed value for your house, and it’s usually lower than the market value. That’s actually a good thing—because the amount you pay in property tax is based on that lower value!

How Do You Find the Taxable Value of Your Home?

Have no idea what the assessed value of a home is? Do a quick search of properties on the website of your county tax assessor. Since local governments set property tax rates, the amount you pay depends on where you live.

Insurance

Know Your Homowner's Insurance Policy

After black mold damage claims which resulted in massive insurance payouts in Texas in the late 1990s, insurance companies reduced coverage in homeowner’s policies for damage caused by water. As you shop for coverage for your home, make sure that you understand the limits of your policy concerning incidents such as slab leaks, sewage backup, and flooding.

These disasters--which cost Texans thousands of dollars in destruction and hardship each year--are not routinely covered in most policies.

Flooding

Policies often cover water falling down from the sky, such as rain, but not rising from below, such as flooding.

Sewage backup

Cities are not liable for damage caused by sewage which backs up into your home from the line at the street.

Slab leak

Pipe breaks in the slab can cost thousands to locate and repair, not to mention damage done to foundations, flooring, and furniture.

Information About Property Insurance for a Buyer or Seller